As a small business owner, managing your finances effectively is crucial for the success and growth of your company. With numerous accounting programs available in the market, choosing the right one can be a daunting task. In this article, we will explore the different types of accounting programs, their features, and benefits, to help you make an informed decision.

Types of Accounting Programs

There are several types of accounting programs available, including:

- Cloud-based accounting programs: These programs are hosted online and can be accessed from anywhere, at any time, as long as you have an internet connection. Examples of cloud-based accounting programs include QuickBooks Online, Xero, and Zoho Books.

- Desktop-based accounting programs: These programs are installed on your computer and can be used offline. Examples of desktop-based accounting programs include QuickBooks Pro, Sage 50, and Peachtree.

- Mobile accounting programs: These programs are designed for use on mobile devices, such as smartphones and tablets. Examples of mobile accounting programs include Expensify, Mint, and Wave.

- Open-source accounting programs: These programs are free to use and modify, and are often developed by a community of users. Examples of open-source accounting programs include GnuCash and TurboCASH.

Features of Accounting Programs

When choosing an accounting program, there are several features to consider, including:

- Invoicing and billing: The ability to create and send invoices, as well as track payments and outstanding balances.

- Account tracking: The ability to track and manage multiple bank and credit card accounts.

- Expense tracking: The ability to track and categorize expenses, as well as generate expense reports.

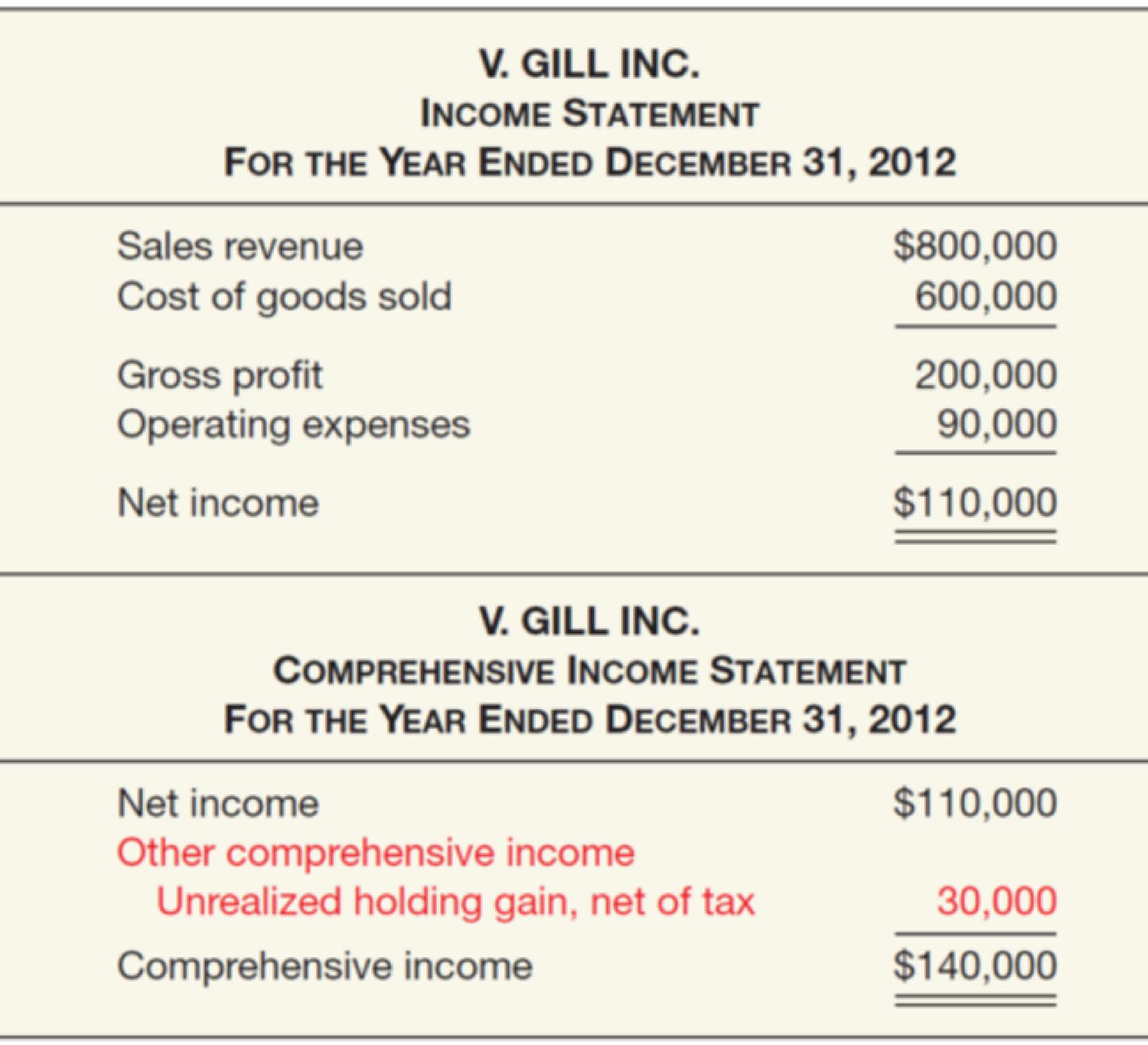

- Financial reporting: The ability to generate financial reports, such as balance sheets and income statements.

- Tax preparation: The ability to prepare and file tax returns, as well as generate tax estimates.

- Inventory management: The ability to track and manage inventory, as well as generate inventory reports.

- Payroll management: The ability to manage payroll, including calculating wages and taxes.

Benefits of Accounting Programs

There are several benefits to using an accounting program, including:

- Improved financial management: Accounting programs help you to track and manage your finances, making it easier to make informed business decisions.

- Increased efficiency: Accounting programs automate many tasks, such as invoicing and expense tracking, saving you time and reducing errors.

- Enhanced accuracy: Accounting programs help to reduce errors, such as math mistakes and lost receipts, ensuring that your financial records are accurate and up-to-date.

- Scalability: Accounting programs can grow with your business, providing the tools and features you need to manage your finances as your business expands.

- Cost savings: Accounting programs can help you to save money, by reducing the need for manual data entry and minimizing the risk of errors.

Popular Accounting Programs for Small Business

Some of the most popular accounting programs for small business include:

- QuickBooks: QuickBooks is a comprehensive accounting program that offers a range of features, including invoicing, expense tracking, and financial reporting.

- Xero: Xero is a cloud-based accounting program that offers a range of features, including invoicing, expense tracking, and financial reporting.

- Zoho Books: Zoho Books is a cloud-based accounting program that offers a range of features, including invoicing, expense tracking, and financial reporting.

- Wave: Wave is a cloud-based accounting program that offers a range of features, including invoicing, expense tracking, and financial reporting.

- FreshBooks: FreshBooks is a cloud-based accounting program that offers a range of features, including invoicing, expense tracking, and financial reporting.

Frequently Asked Questions

- What is the best accounting program for small business?: The best accounting program for small business depends on your specific needs and requirements. Consider factors such as the size of your business, the number of users, and the features you need.

- How much do accounting programs cost?: The cost of accounting programs varies, ranging from free to several hundred dollars per month. Consider factors such as the number of users, the features you need, and the level of support required.

- What is the difference between cloud-based and desktop-based accounting programs?: Cloud-based accounting programs are hosted online and can be accessed from anywhere, at any time, as long as you have an internet connection. Desktop-based accounting programs are installed on your computer and can be used offline.

- Do I need to be an accountant to use an accounting program?: No, you do not need to be an accountant to use an accounting program. Many accounting programs are designed to be user-friendly and easy to use, even for those with no accounting experience.

- Can I use an accounting program for personal use?: Yes, many accounting programs can be used for personal use, such as managing household finances or tracking personal expenses.

Conclusion

Choosing the right accounting program for your small business can be a difficult decision, but with the right information, you can make an informed choice. Consider factors such as the size of your business, the number of users, and the features you need, and choose a program that meets your specific requirements. With the many benefits of accounting programs, including improved financial management, increased efficiency, and enhanced accuracy, you can trust that your finances are in good hands. Whether you choose a cloud-based, desktop-based, or mobile accounting program, you can rest assured that your business is well-equipped to manage its finances and achieve success.

Closure

Thus, we hope this article has provided valuable insights into Accounting Programs for Small Business: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!